From our Local Dailies DisADvantage desk

As you splendid readers likely have seen by now, Fenway Park’s concession workers went on strike today, just in time for the big weekend set between the Boston Red Sox and the Los Angeles Dodgers. Boston Globe correspondent Yogev Toby filed this piece about an hour ago.

Fenway Park concession workers walked off the job Friday ahead of a three-day series between the Red Sox and the Los Angeles Dodgers as negotiations with the ballpark’s concession company failed to produce a contract agreement.

Just hours before tens of thousands of fans would arrive for the game, dozens of workers began walking picket lines after a strike deadline of noon Friday passed. The union, Unite Here Local 26, said it would maintain the picket lines round the clock during the weekend series.

The union encouraged fans to come cheer for the Sox, but avoid purchasing food or drinks in the ballpark.

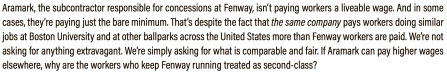

Earlier today, Unite Here Local 26 ran this full-page ad on A3 of that same stately local broadsheet.

Won’t work for peanuts graf:

Right – no one wants to be treated like a second-class citizen. So why did the union do exactly that to the Boston Herald? If Local 26 can pony up for a full page in the Globe, surely the union has enough lunch money to do the same at the Herald.

To be sure graf goes here . . .

To be sure, no one will ever accuse the funky local tabloid of operating at the pinnacle of Big J journalism. But this town is still better off for its presence, and the hardreading staff is guessing Herald workers are a lot closer to Local 26ers than their crosstown counterparts.

Also to be sure, Boston GlobeSox owner John Henry might not like to see money flowing to the Herald. But that’s still no reason to make this a one-daily ad town.

Posted by Campaign Outsider

Posted by Campaign Outsider